eNaira and Project GIANT: Why, How, and When Nigeria adopts the Blockchain Technology to create its Digital Currency

There has been some news that the Central Bank of Nigeria is planning on creating a “Cryptocurrency” for the country. To some, it sounds contradictory: Why would Nigeria, which banned the trading of Cryptocurrencies in its banking institutions, less than a year ago, embrace a nationwide digital currency? Well, to answer the question, we would have to first fully understand what eNaira is, what it is intended for, and how it is going to operate.

Table of Contents

What is eNaira?

The first thing you must understand is that eNaira is not a Cryptocurrency. It is true that the technology behind it – i.e. The Blockchain Technology – is exactly the Technology that Cryptocurrencies are built on; however, eNaira varies in the sense that it is a Central Bank Digital Currency (CBDC).

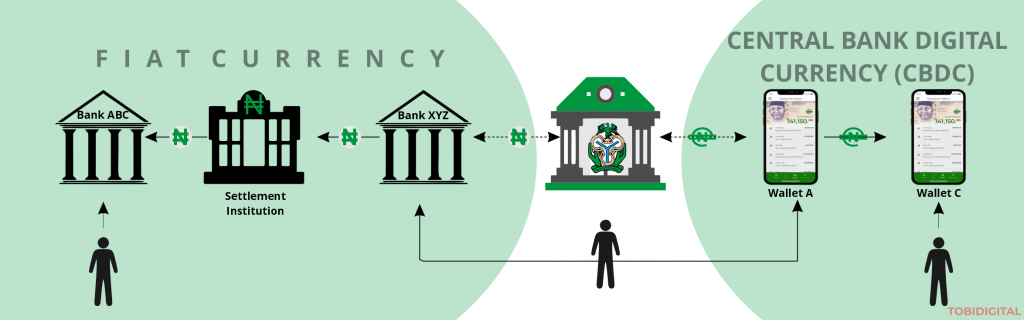

Whilst one of the core objectives of Cryptocurrency is to decentralize control and ownership of the currency, CBDCs aim to centralize the control and ownership of the currency.

What is CBDC, And How Does It Relate To eNaira?

CBDC (Central Bank Digital Currency) belongs to a category of Blockchain Technology, known as a “Permissioned Blockchain”: This is because there are layers of control and access in the Network; which limits each node/party/person/account to operating within the bounds of their permission. That is to say, unlike Cryptocurrencies where everyone has equal rights and power (and are anonymous), CBDC makes it possible for there to be different levels of rights and power, with few identifiable entities on the higher levels of control.

That is to say, though anyone can join the network freely, they would only be able to access as much as they have been permitted to. This permission is often given automatically once they reach the requirements of the network. Each level of access and control has its special requirements.

With CBDC, Citizens (who would have the lowest level of control and access), may only need to provide basic requirements such as an ID, BVN, or Name and Phone number. For Businesses, it could be a CAC registration tag. Whilst Government and The Central Bank (being the owners) wilds absolute control and unbound access – capable of overriding the control and access of all others in the Blockchain Network.

You could say that CBDCs are Cryptocurrencies with advanced security, and regulations: interestingly, Cryptocurrencies are not considered legal tenders, because they are not backed by the law. But CBDCs are considered legal tenders because the law is fully behind them.

In most cases of use, the value of the CBDCs is pegged to the value of the fiat currency already existing. Hence, they are not volatile (i.e. they don’t rise and fall rapidly, unlike cryptocurrencies), but rather behave more like StableCoins.

Hence, the eNaira is simply a means the Central Bank has decided to digitize the already existing Naira.

The implications of this (on the economy) aren’t earth-shaking; eNaira is estimated to reduce the cost of handling cash by 5-7 percent, but other than that, there aren’t many palpable changes it would bring to the value of Naira. It is also not designed to rival or replace cryptocurrencies. Its usage and benefits are for something entirely different (discussed in the next section). In short, this move would not necessarily improve the value of Naira, but eNaira is ambitious nevertheless.

Why eNaira?

The idea of a country having a digital currency isn’t a novel idea:

With the upsurge of cryptocurrencies, and their furious adoption, the Banking institute couldn’t help but notice the revolution. Hence, many have started to key in on the opportunities that lie in Blockchain technology.

So far, a total of 81 countries (constituting over 90% of the world GDP) have picked interest in getting their digital currency. Out of the 81, 5 have already launched, 14 are in the Pilot stage, 16 are in the Development stage, 32 are in the Research phase, 10 are currently inactive, 4 are still exploring the tech, and 2 had cancelled (or failed).

Aside from being a “trend”, a country adopting Digital currencies, indeed, have many benefits

- For a start, they would not have to print so much paper money anymore. With Digital Currencies holding a valuable stake in the total money available in the country, a lot of “paper” would be spared.

- This would improve the government’s ability to track its funds – the government would be able to know who moved them, where they went, and how they were spent.

- It would reduce friction and fees associated with transferring traditional cash, and this would…

- Aid the free flow of monetary policies – bringing about smother and quicker operations

- Citizens would greatly benefit from it since it would aid financial inclusion: means that individuals and businesses would have easy access to valuable and affordable financial products and services

- It would improve the effectiveness of payment systems, and tax collection, and also

- Encourage and accelerate cross-border trades

Amongst others.

Project GIANT: How Would eNaira Be Created?

The plan to launch the digital version of Naira (i.e. eNaira) was first conceived in 2017 – and was termed “Project GIANT”. It was considered a “critical national infrastructure”, and ever since then, there has been (reportedly) a lot of research and development put in place. And now, after 5 years of work, the Pilot scheme of eNaira has been set to commence on the 1st of October, 2021.

As stated earlier, the CBDC would be built on a Blockchain Network. Consequently, the Hyperledger Fabric Blockchain has been chosen for this purpose due to its robustness, and track record. The Hyperledger Fabric Blockchain is used and trusted by global brands such as Walmart, Sony Global Education, and Honeywell, just to mention a few. The eNaira is also proposed to be run on a Peer-to-Peer (P2P) basis – this is important, as it eliminates the need for middlemen (which makes transactions a whole lot faster and cheaper).

To accomplish this, the Central Bank of Nigeria (CBN) had also selected Bitt Inc. to handle the project due to their trusted track record. Bitt Inc. was responsible for heading the development and successful launch of Easter Caribbean Central Banks’ CBDC in April 2021.

With those settled, the CBN in conjunction with other Government bodies drew out a 4-step plan to launch the eNaira. Once in place, the CBN would be given the sole responsibility of minting the Currency, and distribute it through licensed financial institutions (like Banks), so that individuals and Businesses can proceed to make use of it. Of course, all activities would still be meticulously monitored by the CBN.

How Would eNaira Be Implemented?

Once the eNaira is launched, the roles – levels of access, and control – would be distributed as

- Monetary Authority (Central Bank): They would be responsible for minting, issuing, distributing, redeeming, and destroying the digital currency. They would also be executing, monitoring, and managing all transactions within the Network. They hold the highest access and control.

- Financial Institutions: They would be charged with the task of managing some aspects of the digital transaction as well as carrying out Know Your Cutomers (KYC), and ensuring identity & AML compliance.

- Government Agencies: They would process and analyze transactions. They would also reconcile accounts.

- Businesses And Merchants: These groups would be able to use the eNaira to carry out transactions between other businesses and customers.

- Consumers: They (i.e. the citizens) would make use of the eNaira to buy and sell.

It is important to note that there are not interest rates attached to using eNaira. It is only serving to “provide options”. Though it comes with the perk of drastically reducing transaction cost – even eliminating it in some cases (because of the P2P model it operates on)

All that would be required (for Individuals and Businesses to use eNaira) is a simple eNaira Mobile App: once Verified, Individuals and Businesses can easily plug into the Network, and enjoy faster, cheaper, and safer transactions.

To learn more about the eNaira, you may want to download this pdf on eNaira mode of operation.

Public Reactions To eNaira

There has been a lot of both optimism and pessimism in the air ever since Project GIANT became public knowledge.

On the optimistic side are those who believe the security, speed, and lower transaction fees would be of immense benefit to Nigeria in the long run. While on the pessimistic side, are those who fear that this would give the Government too much power (since they would have indubitable access and control over every eNaira account), lead to infringement of privacy, and afford the Government the power to tax and charge ridiculous fees quickly and effortlessly, with no room for objection, or questioning.

Right now, it is hard to say which is a more accurate prediction of what would happen when the eNaira launches. For all we know, it might just fail like it did in some other countries.

As was pointed out earlier, it is considered a “critical national infrastructure”, and there is nothing inherently wrong with setting up an infrastructure.

The only questions that remain hovering over our heads like excited houseflies are, “would it (i.e. eNaira) be treated like the other infrastructures the country already has?” and if so, “would it be worth the hassle?”.

This is a brilliant idea…

We just hope it doesn’t fail or turn out to be something else…

One thing about our country is that we will copy from others and begin to do something totally different